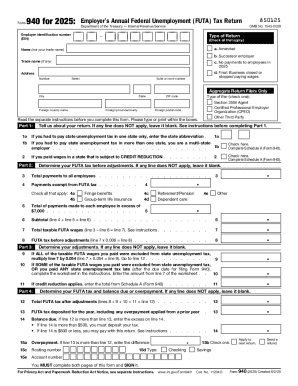

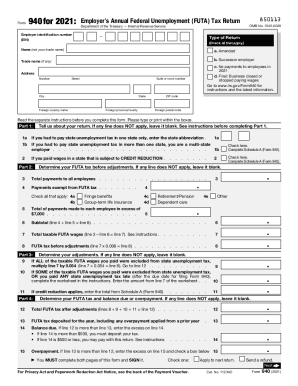

IRS 940 2018 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

About IRS previous version

What is IRS 940?

Who needs the form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about IRS 940

What should I do if I realize I've made a mistake on my IRS 940 after filing?

If you discover an error on your IRS 940 after submission, you should file an amended return using Form 940-X. This allows you to make corrections without facing penalties for the original error. Ensure that you provide a detailed explanation for the corrections made to facilitate the processing of your amendment.

How can I verify the status of my IRS 940 submission?

To check the status of your IRS 940, you can use the IRS's online tools or contact their helpline. Keep your details ready, including the employer identification number, to assist with your inquiry. Tracking is important to confirm that the IRS has received and is processing your filing.

Are there specific errors commonly seen on IRS 940 filings that I should be cautious of?

Yes, common errors on IRS 940 filings include incorrect wage amounts, misclassification of employees, and missing signatures. Being attentive to these details can help you avoid rejections or delays in processing your IRS 940 submission.

What's the best way to maintain security and privacy while filing the IRS 940 electronically?

To ensure security when e-filing your IRS 940, use reputable tax software that offers robust encryption and data protection features. Verify that your internet connection is secure and avoid using public Wi-Fi when submitting sensitive tax documents to minimize the risk of data breaches.

What should I know if I'm filing an IRS 940 on behalf of someone else?

When filing an IRS 940 on behalf of another individual or entity, ensure you have proper authorization, such as a Power of Attorney (POA). This documentation allows you to act on their behalf legally and can simplify processing when you submit the return.

See what our users say